Dubai’s Prime Property Market Sets Global Pace with Record-Breaking Growth

Dubai’s prime residential market, which includes sought-after areas like The Palm Jumeirah, Jumeirah Bay Island, and Emirates Hills, has experienced a staggering 26.3% price growth over the past year. This surge has solidified Dubai’s position as one of the fastest-growing prime real estate markets globally.

In the first half of 2024, Dubai’s property sector saw a remarkable year-on-year volume growth of over 30%, as reported by Property Monitor. May 2024 was a record-breaking month, with sales transactions increasing by 47.7% month-on-month and 45.9% year-on-year.

The demand for villas continues to rise, driven by Dubai’s growing and maturing population. Property Monitor’s H1 2024 figures show significant volume growth in villa sales, as residents increasingly seek family-friendly, long-term living options. Developers responded by launching 3,323 villas in the first half of 2024, with many projects slated for completion by 2028. Key master community projects by Emaar, such as The Oasis, The Heights Country Club and Wellness, and Grand Polo Club & Resort, have attracted substantial interest from investors.

Image credit: CBRE

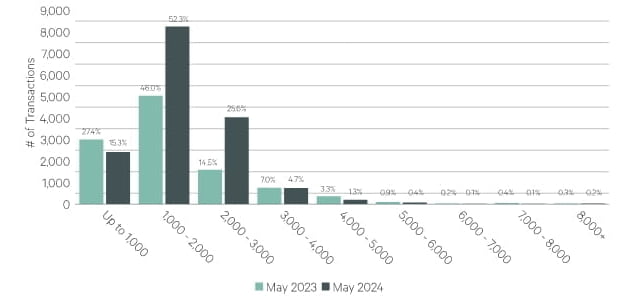

According to a report by CBRE, market dynamics have experienced a significant transformation in the first half of 2024, particularly evident in the shifting transaction price brackets.

In May 2024, sales for properties priced below AED 1,000 per square foot experienced a decline of 19.3 percent compared to the same period last year. In contrast, transactions within the AED 1,000 to AED 2,000 per square foot range saw a substantial increase of 64.1 percent. The most remarkable growth was observed in the AED 2,000 to AED 3,000 per square foot category, which witnessed a staggering 154 percent surge in activity.

These trends indicate a clear movement towards higher-priced property transactions, highlighting evolving buyer preferences and confidence in the market’s upper segments.

High Demand for New Real Estate Projects

More than 80% of new property units launched in Dubai since 2022 have sold out, underscoring the strong demand for off-plan projects. According to Dubai Land Department data, nearly 214 projects were launched, with 148 currently active. Despite concerns about potential oversupply, new stock absorption remains high, with at least 70% of units launched since 2022 already sold.

Trends in Property Buying in Dubai

Sales prices for apartments and villas in prominent Dubai neighborhoods have recorded significant increases. The most notable was a 17% rise in villa prices in The Valley by Emaar during the first half of 2024. This trend highlights the growing appeal of Dubai’s real estate market to both local and international buyers.

With $1.73 billion in luxury home sales in the first quarter, Dubai has surpassed traditional luxury markets like London and New York, establishing itself as the world’s premier destination for high-end real estate investments.

Dubai’s appeal to international high-net-worth individuals remains strong, driven by the city’s global connectivity, favorable interest rates, and policies that promote long-term residency. The inventory of $10 million-plus homes has dropped by 59% in the past year, indicating persistent demand. Despite the rapid price appreciation, Dubai remains one of the most affordable luxury markets worldwide. For $1 million, buyers can acquire 980 square feet of prime residential space in Dubai, significantly more than in New York, London, or Monaco.

Dubai Hills Estate has become one of the fastest-growing prime areas for domestic buyers, with prices rising nearly 11% in the past year. The area’s proximity to key locations, excellent amenities, and green spaces make it increasingly desirable, though available inventory has sharply declined.

Dubai Golden Visa for Investors

Golden Visa rules have brought more interest from investors in Dubai’s real estate. With a minimum AED 2 million (approximately 545,000 USD) investment now required to obtain the visa, the market saw a 30% growth in 2024, driven largely by foreign buyers, according to the Dubai Land Department. The Golden Visa provides a path to long-term residency, which has boosted confidence among investors. A recent survey revealed that 68% of Golden Visa holders in Dubai own property, highlighting the visa’s significant role in attracting global buyers and enhancing the local real estate market.

Global Investors Flock to Dubai

British, Indian, Chinese, Lebanese, Canadian, French, Italian, Dutch, Pakistani, and Turkish buyers were among the top purchasers in Dubai’s real estate market during the first half of 2024, reflecting the emirate’s broad international appeal.

Dubai Property Market Maintains Robust Growth in 2024

As the first half of 2024 concludes, Dubai’s property market continues to thrive, with foreign buyers driving growth and existing inventory being absorbed quickly. High rental yields, accessible financing, and attractive residency options are key factors contributing to this trend.

Share with: